The unavoidable recession to fall over America

February 12, 2023

When an economist uses the word “recession” in their sentence, goosebumps appear on the listener’s skin. When speaking about a recession it usually identifies a hard time in the economy, and that is exactly what is coming our way.

To the readers who are not taking an economics class this year a recession means, “two consecutive quarters of negative Gross Domestic Product,” said Fullerton College professor Lee Cockerill. To be quick and simple, GDP, or gross domestic product, is the total value of all products sold and purchased services.

Cockerill gave his insights for the near future of the U.S. economy saying, “There are two scenarios that can take place, there will be a recession or a bad recession.” He further stated that the best scenario would be no GDP growth. Meaning that the economy won’t go up, but it won’t take a drastic fall either.

Cockerill explained that the worst scenario would be the reappearance of stagflation. “You have no growing economy, high unemployment and you have inflation. The worst of all.”

This means that prices will go up at the same time as inflation, all while the unemployment rate increases. “When you get into stagflation spiral it becomes really tough to stop it,” said Cockerill.

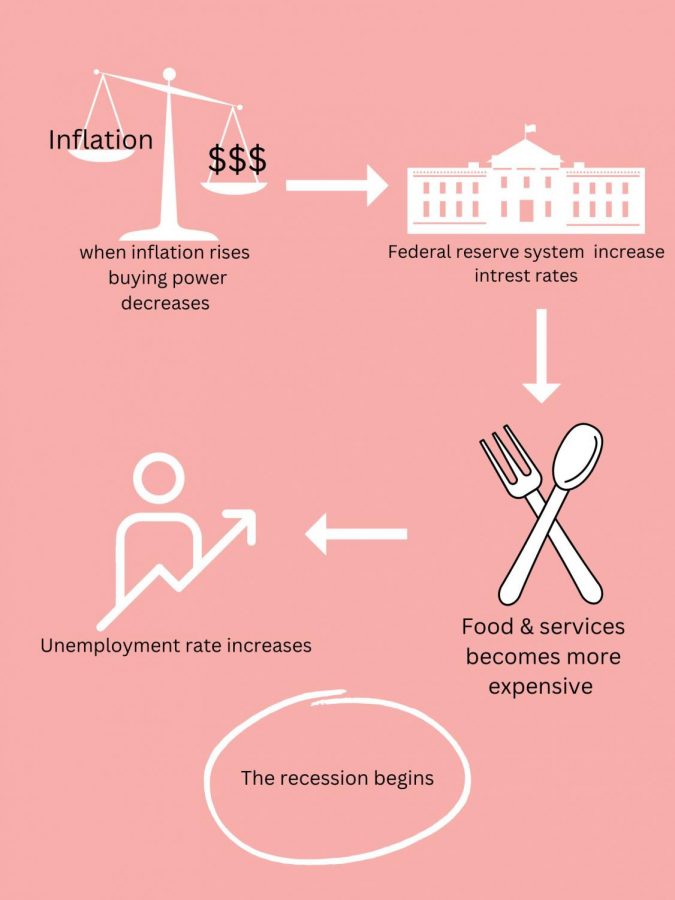

So what are the underlying variables that can lead us into a recession? Inflation and high interest rates. There is no way one can exist without the other, when inflation begins to rise interest rates will also follow the trend.

Cockerill explained that The Federal Reserve System controls the interest rates. “Their main goal is to keep the inflation rate at 2% per year.” To put it into context, the current U.S. inflation rate is at 6.45% according to the Federal Reserve. The solution to this would only be to increase interest rate.

So what does this mean for the daily consumer? It means that everyone should expect all prices to go up, from your cup of coffee to your oil change, all goods and services will have to partake in these unfortunate trends in order for the economy to cool down.

Cockerill believes that inflation is here to stay, “Prices are easy to go up but sticky to go down.” When interest rates go up businesses have no other choice but to increase their prices in order to stay open, but when inflation and interest rates decrease those same businesses will keep their prices the same as if inflation was still around making the prices “sticky”.

There is always light at the end of a tunnel. No matter how long it takes us to get there we will alway find our way out, and this is no different. Preparing for what might come is a priority. By having healthy spending habits and a stable source of income, this predicted recession should not be something to fear but something to be prepared for.