Simplification took a quick turn to overcomplication. The 2024-25 FAFSA rolled out with 33 issues, 15 of which remain open in its fourth month of release due to changes that the FAFSA Simplification Act implemented.

The FAFSA application became available two months later than previous years, which has delayed colleges’ and universities’ processes of rolling out financial aid to students.

Worries have become escalated for students who depend on financial aid to attend college, as college enrollment deadlines are quickly approaching.

The major concern is that applications are incomplete due to ongoing errors and there is an inability to fix them. There are also worries due to changes in grant eligibility calculations, adding to the pressures for students.

Here is a recap of important changes and updates to the 2024-25 FAFSA applications to help students understand grants as they roll out and better estimate a timeline to work around open issues.

New Calculation for Student Aid

In previous years, the system used the Expected Family Contribution (EFC) to calculate how much a guardian contributed towards a student’s education expenses, which affects eligibility for Federal Pell Grants. The EFC is divided by the number of household members enrolled in college.

An issue with the EFC is that oftentimes, families can’t pay that “expected” amount.

The new FAFSA simplification replaces this calculation with the Student Aid Index (SAI), which will no longer consider household members enrolled in college.

According to NASFAA, students in this situation make up some of the 56,600 students who are anticipated to lose Pell Grant eligibility due to the removal of the “sibling discount.”

The benefits of this new calculation are that it takes fewer questions to answer on the FAFSA form. It is intended to expand the Federal Pell Grant to more students, and it links eligibility to family size and the federal poverty level.

On March 22, FAFSA announced that it discovered an error in calculating the Student Aid Index (SAI) for dependent students with assets.

The Student Contribution from Assets (ISIR field 328) did not include the student’s Current Net Worth of Investments and Total of Cash, Savings, and Checking Accounts. The issue caused a lower-than-expected SAI and an inaccurate total Student Contribution from Assets value.

FAFSA has currently fixed the problem for all future Institutional Student Information Records (ISIRs). However, colleges received approximately 200,000 ISIRs before March 21, which were affected by the issue.

By May 1, FAFSA is currently targeting the sending out of reprocessed records.

Contributors need a StudentAid.gov account to input tax information.

The Direct Data Exchange (DDX) replaces the IRS Data Retrieval Tool (DRT).

The FTI module can import Federal Tax Information (FTI) with the user’s consent through their StudentAid.gov account.

Completing FAFSA and Open issues.

1. Contributors and students create a Federal Student Aid (FSA) ID.

Issue: If a student tries to invite a parent to the 2024-25 FAFSA with a foreign address and no

SSN, they’ll get an “Unable to Complete This Action” error.

Workaround: Students can enter all zeros (00000) in the parent’s zip code field to send the invitation without affecting the parent’s ability to create an account.

2. Start the FAFSA form at fafsa.gov

Issue: On specific internet browsers, the “My Activity” section of the StudentAid.gov Dashboard does not load when a 2024-25 FAFSA form already exists for a user.

Workaround: Contributors need to use a computer with an updated version of Google Chrome

3. Fill out the Student Demographics section.

4. List the schools to which you want your FAFSA information sent.

Note: You can now add 20 schools to your list, double the amount in previous years.

5. Answer the dependency status questions.

6. Fill out the Parent Demographics section.

Issue: Exiting the FAFSA form without completing spouse information will prevent the student or parent from adding this information when they re-enter the form when submitting it.

Workaround: They can manually navigate back to the start of the “Financials” section, move through the form to the “Invite your spouse to the FAFSA Form” page, and complete the information before submitting it.

7. Contributors supply your financial information.

Issue: All users without a Social Security number (SSN) must manually enter their financial information into the FAFSA form.

There is no current workaround for this issue or estimated timeline for resolution.

8. Sign the student’s FAFSA form.

Important Note: If the 2024-25 FAFSA contains all necessary information except for signatures/submission, it will show as “In Progress” in My Activity for users who have yet to complete those final steps.

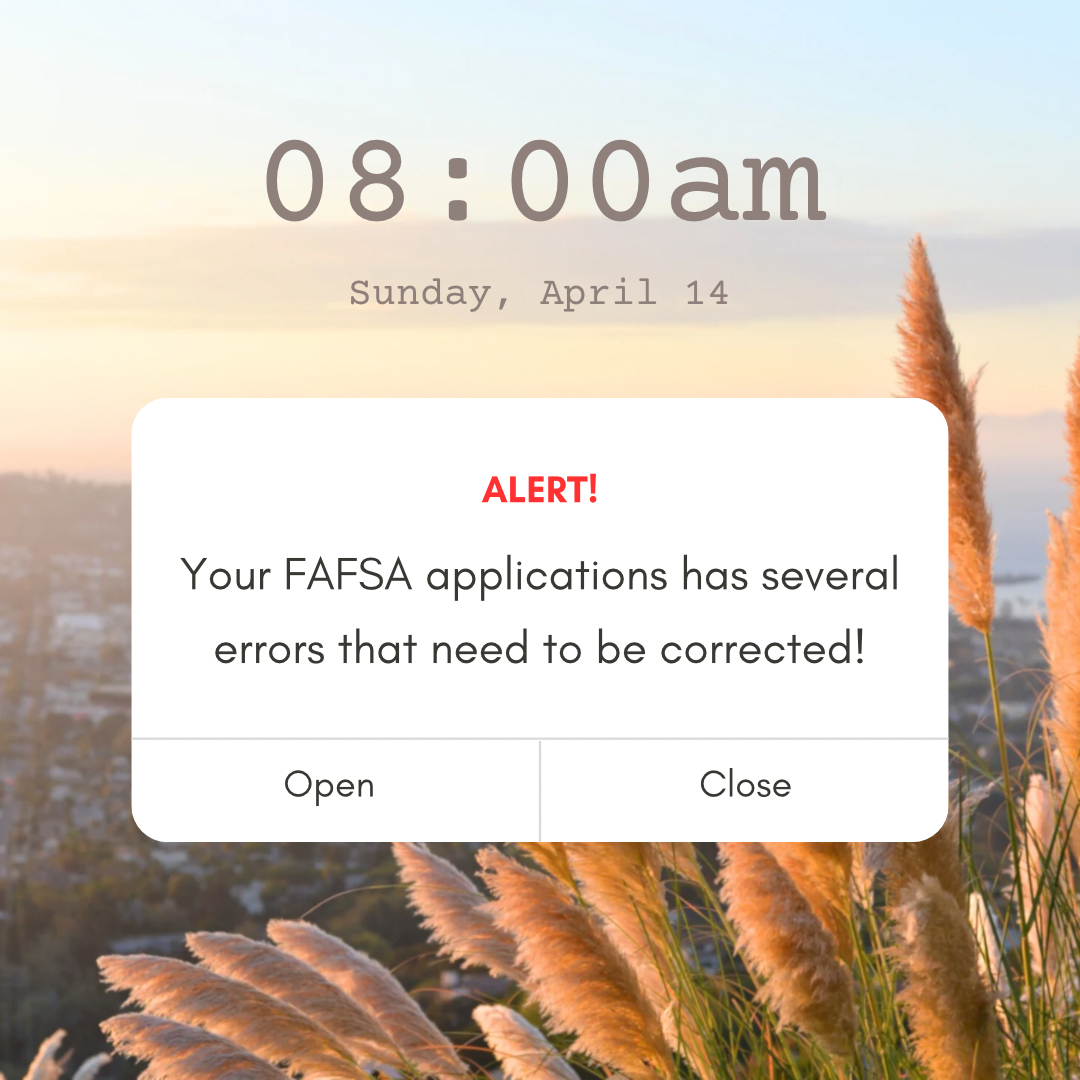

Not able to make corrections.

Currently, students are unable to make corrections to submitted FAFSA forms. On Tuesday, April 9, FAFSA stated that they expect to make student corrections available early next week.

CSAC rolls out FAFSA Alternative

For students with remaining issues with processing their SSNs while submitting the FAFSA, an additional alternative has been rolled out for first-time financial aid applications for students who have never submitted FAFSA.

The California Student Aid Commission (CSAC) has opened the California Dream Act Application (CADAA) to students with these qualifications. It’s important to note that CSAC is working towards making this application available for renewal students.

For California financial aid programs, submit your application no later than May 2, 2024.

For additional community college Cal Grants, apply by Sept. 3, 2024.

Check with the financial aid office at the college or career school you plan to attend for more information on available state aid and deadlines.