Many college students must balance their schedules between work and school to be able to get good grades and afford daily necessities. In college, some expenses come down to tuition, books, school supplies or gas for those who commute daily. Many students also have to worry about other expenses like groceries, phone bills, rent, or any extra spending.

The cost of living also continues to get more expensive each year in the state of California, leading many people to suffer from financial insecurity. The Los Angeles Times reported that based on the Bureau of Labor Statistics, consumer prices in the Los Angeles area in December rose 3.5% from the year prior, which is slightly higher than the national average for all urban consumers. The year-over-year inflation rate for the Bay Area in December was 2.6%.

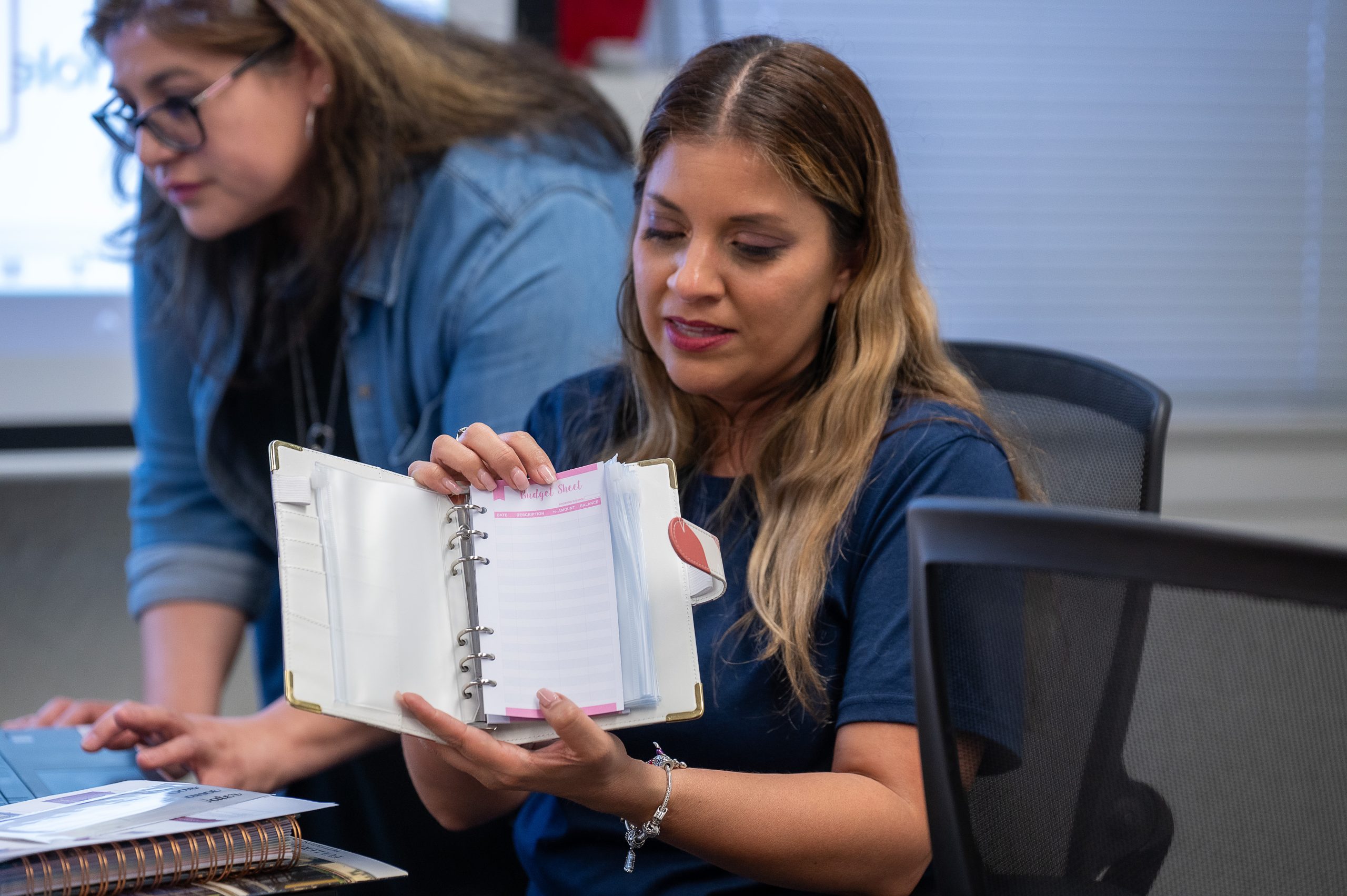

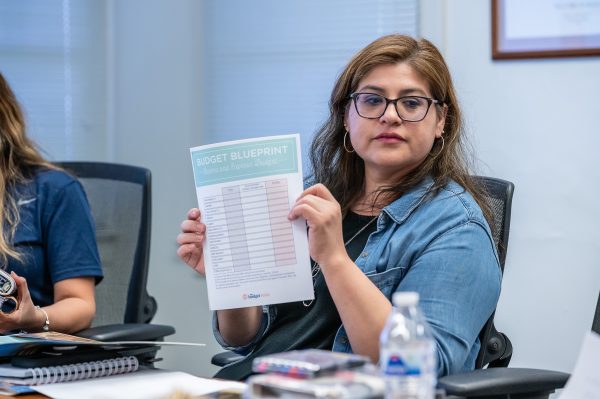

Fullerton College CalWORKs counselor Mayra Novasky went over how to live on a budget with students through their budgeting workshop on April 11, an event that is hosted every semester on campus at the Ben Franklin House, located on 315 N. Pomona Ave.

The workshop consisted of going over what a budget is and why it is so important for students to create one. Norvasky explained that the importance of budget comes down to two things. It will help determine how much to split the costs between necessities and bills, and also, it gives an overall idea of how to spend money, cutting off unnecessary purchases.

“I think the important thing is knowing what takes priority,” Novasky said. “Of course, make time and money for having fun, but just keep track and prioritize survival things like rent, car payments, or bills.”

Novasky shared many methods throughout the workshop that intend to guide anyone to be more organized with their money. The workshop provided a budget blueprint course which breaks down the step-by-step guidance needed to create a successful budget using the cash envelope method.

The method is broken down into a six-day process to figure out a budget that best suits your financial conditions. Tips and steps are provided through each day that follow along with the previous day’s tips. Through this method, one will help distinguish between unnecessary and necessary spending each month.

“I’m going to go home and fill out all the budget worksheets we were provided with and figure out what’s coming and going with my spendings and just setting my goals,” sophomore Human Services major Arlene Ramos said.

Ramos, a mom herself, said that her main goals are to save up money for her kid’s college education and for any emergency spending that may come along the way.

The daily $12 meal card and the Food Bank were some of the things Ramos said that had helped her and her family the most from all college services. “I get my kids their snacks from the cafeteria, I use the $12 a day and just stock up. It really helps out a lot,” Ramos said.

The food bank offers the Healthy Hornet drive-thru every Thursday from 9 a.m. to 12 p.m. where students can pick up free groceries like dairy products, vegetables, and canned food. There are also diapers, wipes, and feminine products provided as well.

FC students can also look into applying for the CalWORKs program, where they offer emergency benefits like emergency rental assistance, bus passes, free eyeglasses, and so forth. In order to file for it, you must contact the department of CalWORKs to schedule an appointment with a counselor and verify if you are eligible for their program.

CalWORKs members also have access to apply for the Golden Bear pass. With it, students can receive free parking to any state park and beach.

“Find out what’s available for you on campus. Talk to your peers. Sometimes they have ideas, or use things you’ve never heard about,” Novasky said. “Reach out to counselors and faculty who might know of the resources on campus, there is help out there.”